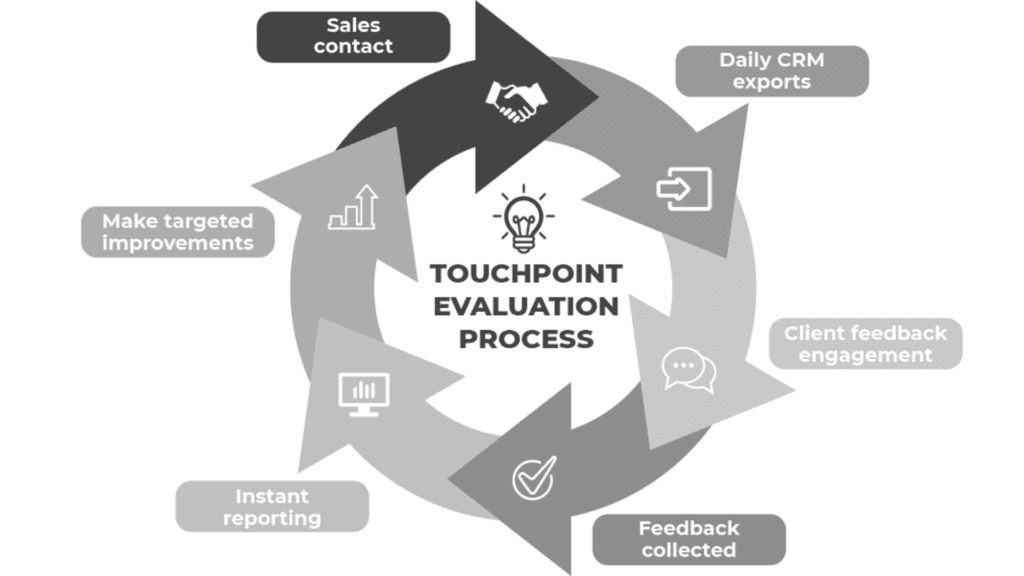

Touchpoint Evaluation

Optimize sales with Touchpoint Evaluation, measuring client interaction effectiveness and improving customer experience.

Get a Clear Lens on Your Client Experience

The Touchpoint Evaluation process gathers feedback from your clients’ following interactions with your team and organization. The tool helps you measure the impact of individual client interactions, giving you an edge in the highly competitive financial services environment. Environics clients use Touchpoint Evaluation to drive continuous improvement and deepen customer engagement.

Real-time Feedback

Our customizable salesforce evaluation framework easily integrates into your existing sales management program by allowing customers to provide feedback after connecting with your company. Ratings and comments are then shared with sales managers through a live dashboard, allowing your teams to quickly and effectively respond to issues and opportunities as they arise.

Your Performance In Context

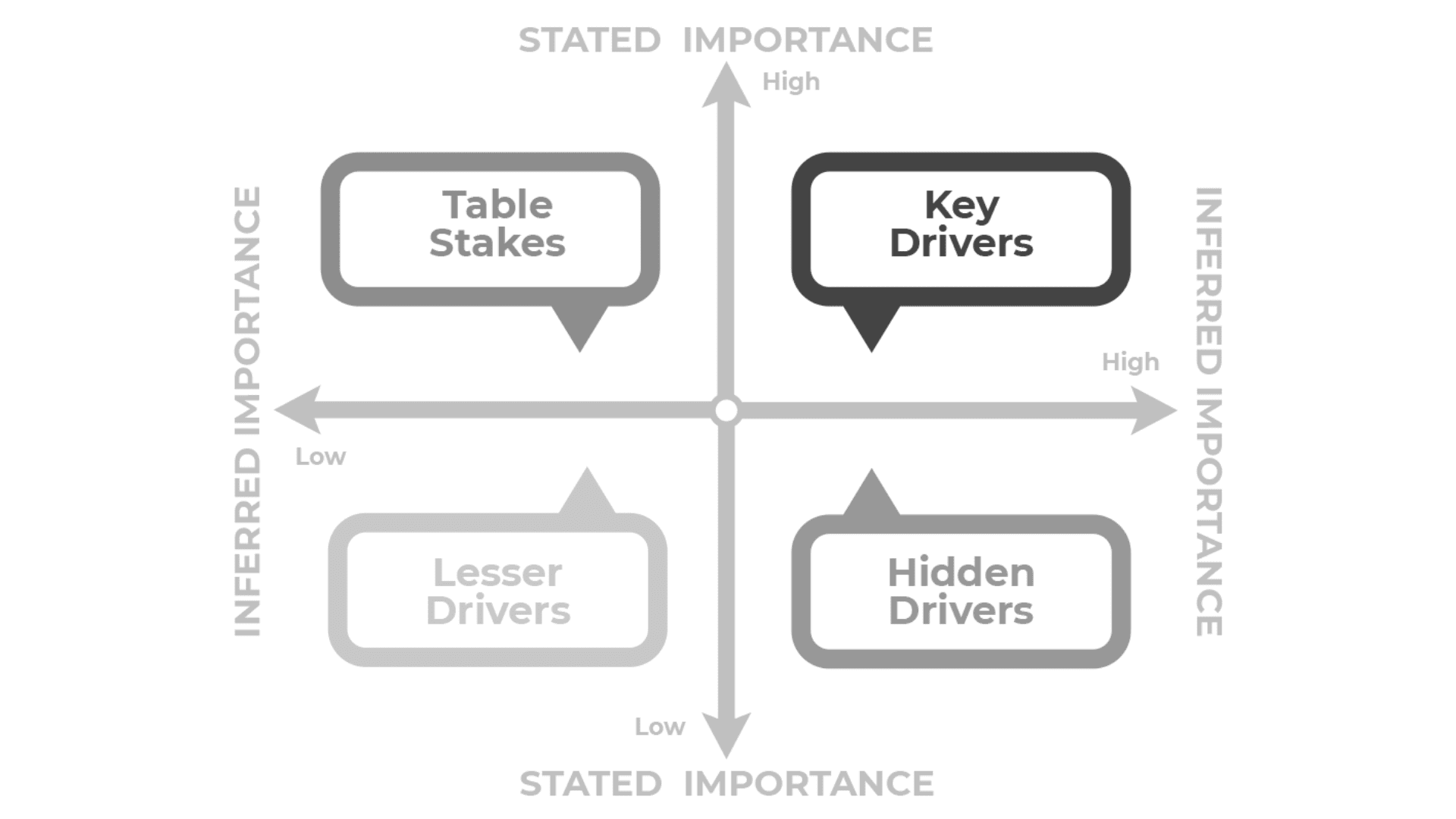

The Touchpoint Evaluation framework is supported by Environics’ annual Advisor Perception Study which explores the factors that are most important to advisors, planners, and insurance brokers, and tracks how different brands perform on these dimensions.

Practical Applications

“Environics’ Touchpoint Evaluation process offers timely insights into key attributes that are important to our customers at a grass roots level. The ability to review results with regularity provides us with the agility to create a better customer experience quickly.”

Lisa Trudell

Vice President, National Sales, Sagen

Insights That Matter

The Touchpoint Evaluation process has a range of uses and benefits, helping you to:

- Respond in real-time to customer feedback

- Optimize the effectiveness of high-value sales channels

- Understand the relationship between the types of interactions you have with clients, and the quality of that client’s experience.

- Evaluate the impact and effectiveness of tactical organizational changes.

- Gather actionable data for coaching and development of customer service-facing team members.