Patients Are More Than Just Their Age: The Importance Of Segmentation In The Health And Wellness Industry

ARTICLE BY

VIJAY WADHAWAN

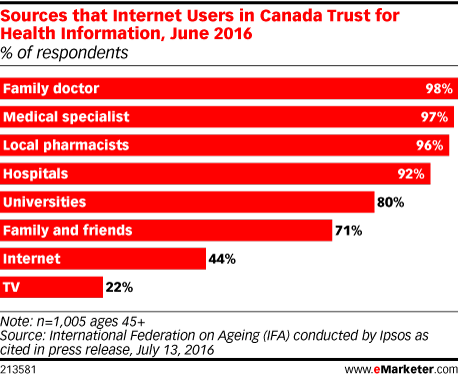

At the same time, two other studies conducted in 2016 caught our attention with similarly interesting results. The first, a study conducted by the CRTC in March, indicated that 90% of Canadian respondents aged 18 and older had, in fact, researched health information online in the past 12 months. For comparison, in 2010 that number was only 64%. The second, a study from the International Federation of Aging (IFA) that sampled a population of Canadians aged 45 and older in June, showed that virtually all respondents trusted their family doctor for health information. However, only 44% would trust health information found on the Internet, despite the fact that most had gone online to get such information.

All of these results taken together seem to indicate that younger Canadians are moving heavily toward relying on information found online to make their healthcare decisions, while older Canadians are tending to stick with more traditional sources. And, although this trend may seem unsurprising, it’s one that health and wellness brand managers should be analyzing more closely.

Having extensively researched and studied the topic of effective brand strategies, our Health and Wellness team understands that the most effective strategy is one that targets both physicians and patients. With our deep understanding of both stakeholder groups, we can help you not only answer the “what?” but also the “why?” when it comes to behavioural trends of each group and unique characteristics of segments.

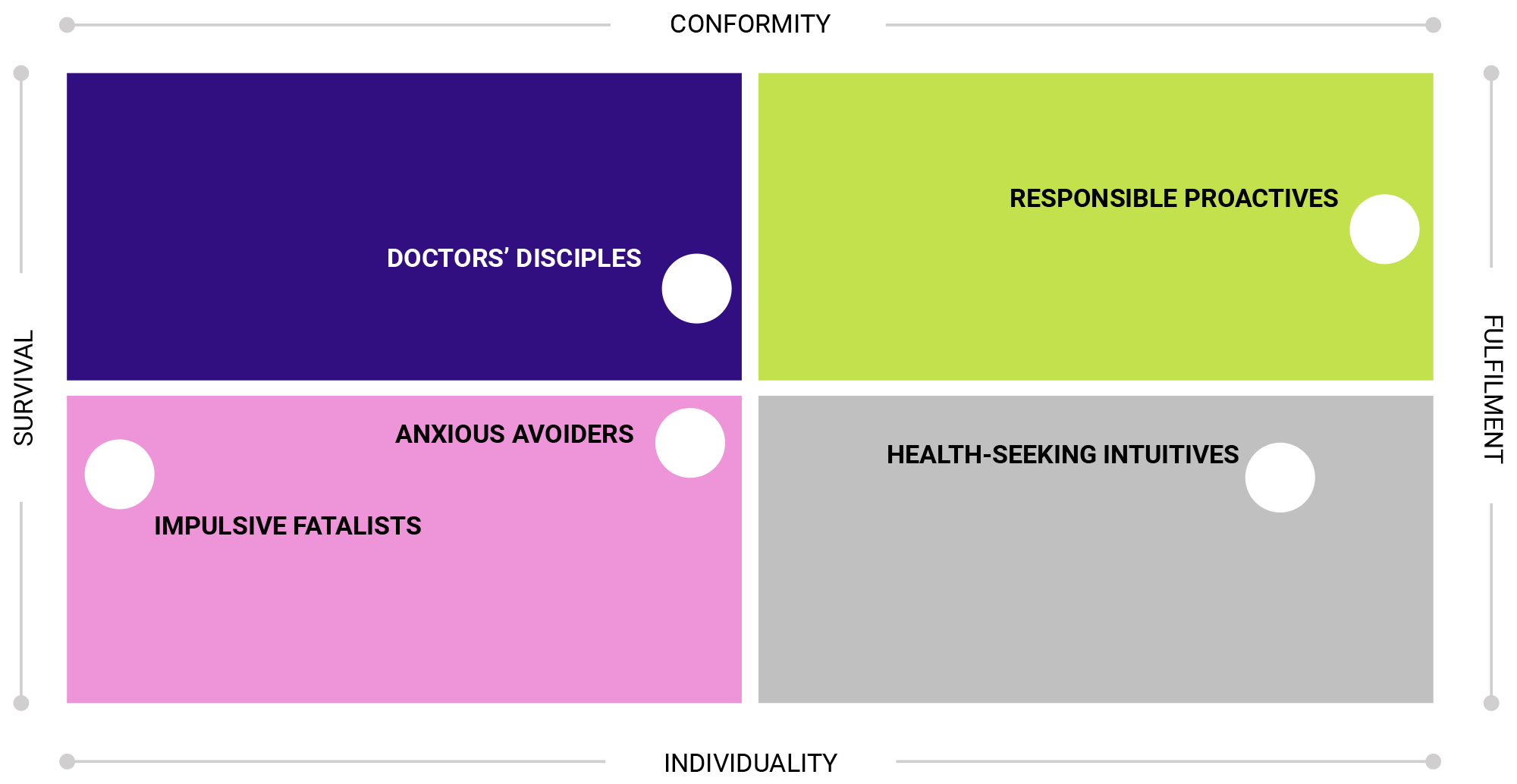

Using our PatientConnect™ proprietary value-based database, our team has been able to segment patients into five distinct groups based on their opinions and perceptions toward health and wellness. By understanding the differences between these patient groups, we can work with brand managers to maximize the effectiveness of their marketing messages.

Looking at our PatientConnect™ data, we note with some interest that three specific patient segments dominate Canadians aged 45 and older. Our Health and Wellness team refers to these segments as Responsible Proactives, Health-Seeking Intuitives, and Doctor’s Disciples. By looking more closely at these specific segments, we can move well beyond the understanding that Canadians 45 and older are less likely to trust the Internet for medical advice, and drill down to a greater understanding of the patients who make up that cohort and why they would be more trustful of a family doctor than information found on the internet.

Responsible Proactives and Doctor’s Disciples hold the greatest sensitivity to brands among our patient groups, although for very different reasons.

we help our clients to not only understand patient behaviours, but also to uncover the reasons behind those behaviours

Responsible Proactives are brand sensitive because they are always on the lookout for the newest and most advanced treatments (which are usually branded products). Doctor’s Disciples, on the other hand, are brand sensitive because they are drawn to the names they are familiar with, that have an established image, and that have been recommended by their physician. Conversely, patients belonging to the Health-Seeking Intuitives segment tend to be skeptical of pharma brands.

By digging deeper with these PatientConnect™ segments, we help our clients to not only understand patient behaviours, but also to uncover the reasons behind those behaviours. This kind of insight allows brand managers and marketers to communicate messages that resonate through the most effective medium to reach them.

A healthcare brand whose target patient demographic is older than 65, for example, would be best served by focusing their efforts on GP endorsements, as this is the most trusted source of medical information for the Doctor’s Disciples segment. A younger target patient demographic, however, made up of less brand sensitive patients, would require a completely different approach – likely one that targets patients with online messaging during the research stage of their patient journey. Moreover, using the data from PatientConnect™, we can actually locate your target patient segments with postal codes by utilizing the PRIZM5 system of our sister company Environics Analytics to ensure that your marketing dollars are giving you the highest return.

This is the new reality of healthcare in the digital age. As patients become more and more comfortable with online sources of information, many are beginning to make their own healthcare decisions, separate from their doctors – or, at the very least, expecting to have much more input into decisions that are reached collaboratively with their physicians. If healthcare brands expect to get their marketing messages across in an effective manner, their strategies need to adapt to the patient they’re talking to.

Find out how Environics can help your organization

Related insights

Toronto

366 Adelaide Street West

Suite 101, Toronto, ON

Canada M5V 1R9

416 920 9010

Ottawa

116 Albert St

Suite 300, Ottawa, ON

Canada K1P 5G3

613 230 5089

Calgary

421 7th Ave SW

Suite 3000, Calgary, AB

Canada T2P 4K9

403 613 5735